WI Northwestern Mutual Form 90-1940 2010-2026 free printable template

Show details

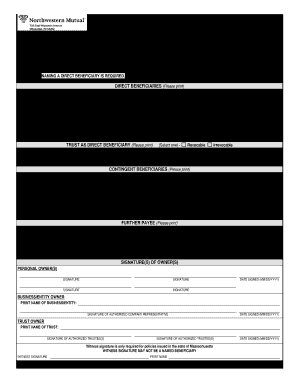

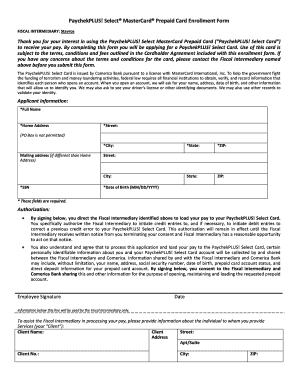

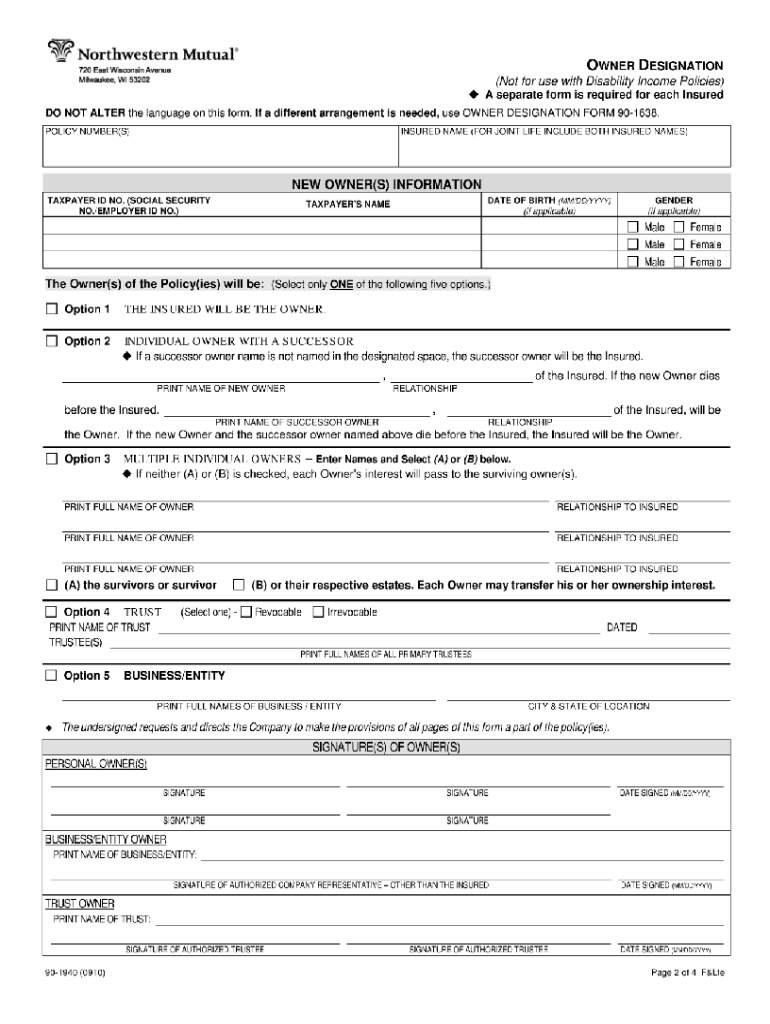

OWNER DESIGNATION REFERENCE PAGE Form 90-1940 NAMING A NEW OWNER The owner form 90-1940 is designed to cover the five most common owner transfers and successor owner designations. Only one ownership

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign northwestern mutual change of beneficiary form

Edit your northwestern mutual beneficiary change form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your northwestern mutual annuity surrender form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing northwestern mutual surrender form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit how to fill out wi northwestern mutual form 90 1940 03. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out northwestern mutual change of ownership form

How to fill out WI Northwestern Mutual Form 90-1940

01

Obtain the WI Northwestern Mutual Form 90-1940 from the official Northwestern Mutual website or your local office.

02

Read the instructions provided at the top of the form carefully.

03

Start by filling out your personal information, including your full name, address, and contact details in the designated fields.

04

Provide the necessary identification details such as your Social Security number or any other required identification information.

05

If applicable, indicate the type of insurance or product you are applying for.

06

Complete any additional sections related to health history or financial information as outlined in the form.

07

Review the completed form for accuracy and completeness before signing it.

08

Sign and date the form at the bottom where indicated.

09

Submit the completed form to your Northwestern Mutual representative or through the appropriate channel as instructed.

Who needs WI Northwestern Mutual Form 90-1940?

01

Individuals applying for life insurance, disability insurance, or investment products offered by Northwestern Mutual in Wisconsin.

02

Policyholders who need to update their personal information or make changes to their existing policies.

03

Beneficiaries applying for claims related to policies issued by Northwestern Mutual.

Fill

northwestern mutual life insurance beneficiary change form

: Try Risk Free

People Also Ask about northwestern mutual forms

What is a job application form called?

Also called an employment form, a job application form enables employees to gather relevant information on the work experience of prospective employees.

How do you properly fill out an application?

0:20 1:27 How to Fill out a Job Application - YouTube YouTube Start of suggested clip End of suggested clip Being sure to explain any gaps. Bring along a fact sheet with work details contact numbers addressesMoreBeing sure to explain any gaps. Bring along a fact sheet with work details contact numbers addresses and references to help you fill out the application.

Who uses application forms?

Who uses them? Employers use them most prolifically in the public sector where it's not about paper-pushing but ensuring there is a systematic way of comparing candidates. Anyone applying for jobs in local or central government schools should expect to fill in an application form for every job applied for.

How do I format an application form?

Best General Practices for Creating Online Forms Only ask for the information you need. Use the right form field items. Use placeholder text to further explain form fields. Keep form pages short and sweet. Notify users about form errors immediately. Use a Success Page as confirmation instead of email.

How do you fill out an application on paper?

How to fill out a job application Read the application before filling it out. Take your time. Answer completely and truthfully. Include your resume. Fill out job information chronologically. Put in the extra effort. Research your salary.

What is an online application for a job?

An online job application is a form on the internet where you can inform a company about your skills and relevant experience for a specific job or position. Companies use online applications to help speed up the hiring process and increase their number of potential candidates.

How do I fill out an application that was emailed to me?

Most forms are sent in pdf format, alas the most common the pdf reader does not let you type in. If this the case you can download and use this free reader. Otherwise print the form, fill it in by hand, scan it to as a file, and send back the scanned file.

What is on an application form?

An application form will usually include sections on personal information, education, work experience and employment history, as well as competency-based questions and a personal statement. Application forms are usually completed and submitted online, although paper versions may be accepted in some cases.

How do you write an application format?

How to write an application letter Research the company and job opening. Use a professional format. State the position you're applying for. Explain why you're the best fit for the job. Summarize your qualifications. Mention why you want the job. Include a professional closing.

What are application forms?

Types of Application Forms Employment Application Form. A form used to collect information from job applicants. Membership Application Form. Rental Application Form. Credit Application Form. Volunteer Application Form.

How do you download an application and fill it out?

0:08 1:27 Learn how to download, fill out and submit forms - YouTube YouTube Start of suggested clip End of suggested clip Click forms. And then click overview right click on the form you want to download. The downloadMoreClick forms. And then click overview right click on the form you want to download. The download option may slightly vary depending on the browser you are using save the file anywhere on your computer.

How do I create a simple application form?

Best General Practices for Creating Online Forms Only ask for the information you need. Use the right form field items. Use placeholder text to further explain form fields. Keep form pages short and sweet. Notify users about form errors immediately. Use a Success Page as confirmation instead of email.

What is application form meaning?

Definition of Application form: An application form is an official document that employers want their job candidates to fill in while applying for a job. The employer would ask a series of questions that candidates must answer.

How to fill online form in mobile?

0:22 3:29 How to fill a PDF form on Android - YouTube YouTube Start of suggested clip End of suggested clip Once you have that downloaded just open up the app and then select a form to fill out on the formMoreOnce you have that downloaded just open up the app and then select a form to fill out on the form click on the space you want to feel and begin typing. So this can be anywhere around the PDF.

How do I create an online application form?

Best General Practices for Creating Online Forms Only ask for the information you need. Use the right form field items. Use placeholder text to further explain form fields. Keep form pages short and sweet. Notify users about form errors immediately. Use a Success Page as confirmation instead of email.

Why do we use application forms?

The application form plays an important part in the selection process, decisions to shortlist candidates for interview are based solely upon the information you supply on your form and the form provides a basis for the interview itself. Curriculum Vitaes (CVs) or resumes alone will not be accepted.

What is meant by online application form?

1. An application form that is completed and submitted via the Internet.

What is an online application form?

An application form that is completed and submitted via the Internet.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pdffiller in Chrome?

Install the pdfFiller Google Chrome Extension to edit northwestern mutual withdrawal form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out northwestern mutual transfer form using my mobile device?

Use the pdfFiller mobile app to complete and sign how to fill out wi northwestern mutual form 90 1940 the appropriate channel as instructed on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit how to fill out wi 03 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign northwestern mutual 1035 exchange form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

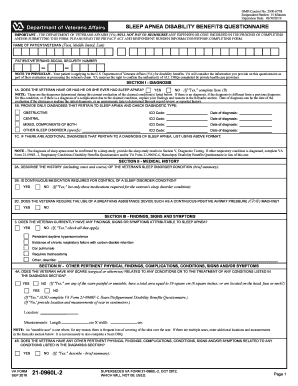

What is WI Northwestern Mutual Form 90-1940?

WI Northwestern Mutual Form 90-1940 is a specific form used by Northwestern Mutual to report certain financial information for policyholders in Wisconsin.

Who is required to file WI Northwestern Mutual Form 90-1940?

Policyholders of Northwestern Mutual in the state of Wisconsin who meet specific criteria related to their policies are required to file WI Northwestern Mutual Form 90-1940.

How to fill out WI Northwestern Mutual Form 90-1940?

To fill out WI Northwestern Mutual Form 90-1940, policyholders should carefully read the instructions provided with the form, ensure they have all necessary documentation and information related to their policies, and provide accurate and complete responses in the designated fields.

What is the purpose of WI Northwestern Mutual Form 90-1940?

The purpose of WI Northwestern Mutual Form 90-1940 is to collect and report financial information required by the state of Wisconsin for the regulation of insurance policies and to ensure compliance with state laws.

What information must be reported on WI Northwestern Mutual Form 90-1940?

The information that must be reported on WI Northwestern Mutual Form 90-1940 includes policyholder details, policy numbers, premium amounts, and any relevant financial transactions related to the insurance policies.

Fill out your WI Northwestern Mutual Form 90-1940 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Northwestern Mutual Life Insurance Change Of Beneficiary Form is not the form you're looking for?Search for another form here.

Keywords relevant to northwestern mutual surrender form pdf

Related to northwestern mutual form designation

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.